This post aims to provide some light on where & how many potential customers of v6-only apps or products are in a per-country basis. Calculations are entirely based on the OECD Countries Internet Usage and Population Statistics & Eric Vyncke's site enabling easy comparisons based on Google per-country IPv6 statistics. Kudos to Eric for his really useful work!

Let's start first with my two pics summarizing the amount & location of v6-only potential customers:

(please note this is a draft approximation based on the methodology described below, so absolute numbers might not be accurate. It includes all kind of users, residential, academic, corporate users, mobile, wifi, etc. Should you have comments/corrections, I am glad to receive them).

To estimate the number of IPv6 users the following assumptions described below have been made:

- Eventually, all Internet users did access Google once or more, given a sufficient period of time.

- v4 and v6 users behave identically in what regards to accessing Google or not.

Additionally, to avoid noisy data in the previous graphs, the following rules

have been applied:

- Only countries with the highest number of v6 accesses or highest accesses growth at this time, as described in the sections below, have been considered.

- Countries with v6 % accesses below 0,1% have been discarded (i.e. highly populated countries with rates far below 0,1%, but still meaning lots of users anyway, are not drawn as few testers might be artificially increasing google hits over v6).

Conclusion: In my opinion, what they call 'Internet users' in the statistics might not mean regular or active users and, therefore, the effective number of them is lower. As a result v6-users as calculated here would be lower too. Perhaps a correction factor based on this assumption should be applied. However, I still think numbers as a reference and comparison to other countries are relevant.

If you are interested on per-region and per-country details, just keep reading.

Enjoy!!

In the

previous post, I strongly suggested IPv6-only as one option to be considered by developers and entrepreneurs. A summary of my arguments follows:

- Avoid v4-Internet constraints for P2P & interactivity.

- Skip the transition mesh.

- Focus now onwards on differentiation, as many others are busy with 1 & 2.

- IPv6 users (your target users/customers) are rapidly growing reaching a critical mass.

In case you are a believer on the above, I think you might be interested to know how many potential customers there are and where they are located. I hope this post gives light on that or at least good sources to make numbers yourself ... I would be happy to know then! ;-)

In the following sections, I highlight those countries within different world regions with a higher penetration of IPv6 or highest growth, according to Eric's page diagrams accessed on Feb 4th 2013.

In the following sections, I highlight those countries within different world regions with a higher penetration of IPv6 or highest growth, according to Eric's page diagrams accessed on Feb 4th 2013.

Please, note that by clicking the URL linked down the diagrams, you'll be redirected to Eric's site displaying current updated figures.

1) North America

The largest

populated country in the region, US (313M)is leading this region with a good and stable

rising trend. Therefore, US is definitely one of the main countries to address

with your IPv6 apps, devices or products.

2) Europe

Europe is

diverse in cultures and languages, so knowing in advance where your users or customers

are or will be shortly is key.

Best in

class, in terms of IPv6 end customers, are Romania (current world

leader in %), France and Luxemburg.

France is

one of the most populated (65M) and well connected countries in Europe, so it seems a proper

place for IPv6 only entrepreneurs.

The

following diagram shows another angle, EU countries with the highest growth at

this point. We can see that Germany (DE) has started to rise over 1% early 2013 and

it is actually the most populated country in Europe (81M).

Significant

growths are also seen in Belgium (BE), Switzerland (CH), Holland (NL) and Portugal (PT).

Finally,

other countries with a significant percentage of accesses (>0,1%) that you

may consider in Europe are shown in the following diagram.

3) Asia

In the case

of Asia, the 3 most populated countries are already suitable for IPv6 only

apps.

Japan (127M) is

leading, showing its historic and renewed commitment. Numbers could be even

higher as we know some filtering was set up in 2011 aiming to reduce W6D'11 brokenness. I suspect numbers grow also as filters at some Japanese ISPs are removed when they know brokenness is actually solved.

China (1,343M) shows

a more strange behavior that may need further study and India (1,205M) finally seems to

have waken up since 2012 Q4 reaching now almost 0,3%.

The

following diagram shows rising trends in Australia (22M), New Zeland, Hong Kong and

Singapore.

4) Latam

Latinamerica

has not yet joined relevant growths for the most relevant/populated

countries. Perhaps, because it seems that

IPv4 depletion is expected to happen later compared to other regions.

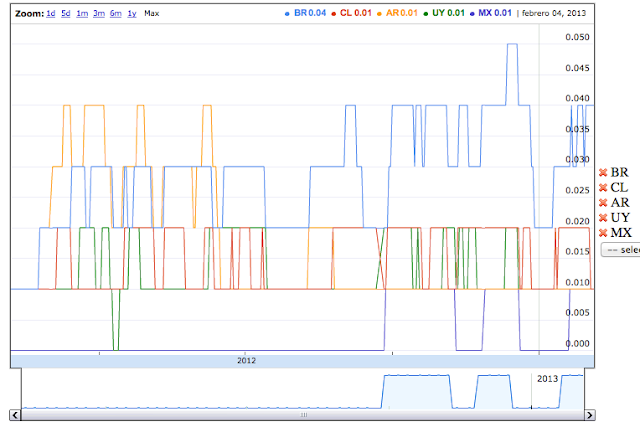

To look for

potential users one should stay tuned to this diagram with Brasil (193M), Chile (17M), Argentina (42M), Uruguay (3M) and Mexico (112M):

There has not been a big move so far. However, there are some countries in the region that are starting to show some interesting variations, maybe due to some tests or early deployments, namely: Peru, Cuba, Ecuador and Honduras.